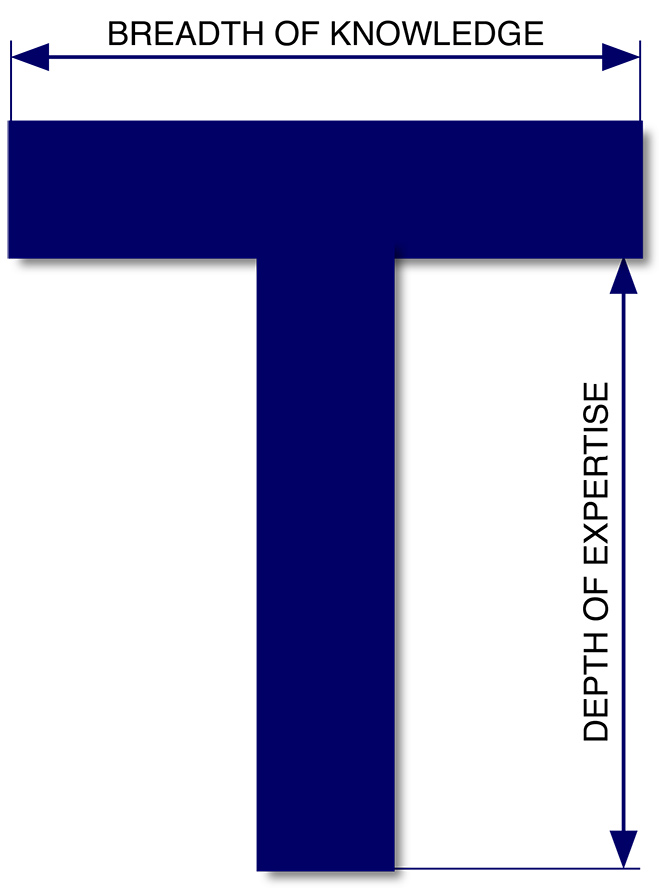

Tim Brown, CEO of IDEO, a legendary design company, is credited with popularizing the concept of “T-shaped” professional. According to Mr. Brown:

T-shaped people have two kinds of characteristics, hence the use of the letter “T” to describe them. The vertical stroke of the “T” is a depth of skill that allows them to contribute to the creative process. That can be from any number of different fields: an industrial designer, an architect, a social scientist, a business specialist or a mechanical engineer. The horizontal stroke of the “T” is the disposition for collaboration across disciplines. It is composed of two things. First, empathy. It’s important because it allows people to imagine the problem from another perspective- to stand in somebody else’s shoes. Second, they tend to get very enthusiastic about other people’s disciplines, to the point that they may actually start to practice them. T-shaped people have both depth and breadth in their skills.

Since its introduction in or around 2010, the intuitive visual metaphor and the idea it illustrates has been widely applied across different fields including legal services and IT. The ability to easily cross between the business and information technology or “speak the language of business” has been consistently named as one of the most coveted skills that IT professionals, everyone from a support analyst to the CIO, should strive to develop.

Yesterday, I attended Microsoft Financial Services Summit, an executive-level event co-hosted by Microsoft and EY. In one of the most informative sessions of the day, Michael Giarrusso and Mark Voytek of EY presented “The Secret of Success: Third-Party Governance that Works” summarizing a recent research report published by EY. According to the report, as many as 60% of financial services organizations still struggle to maintain a clear picture of their 3rd-party partners and downstream service suppliers.

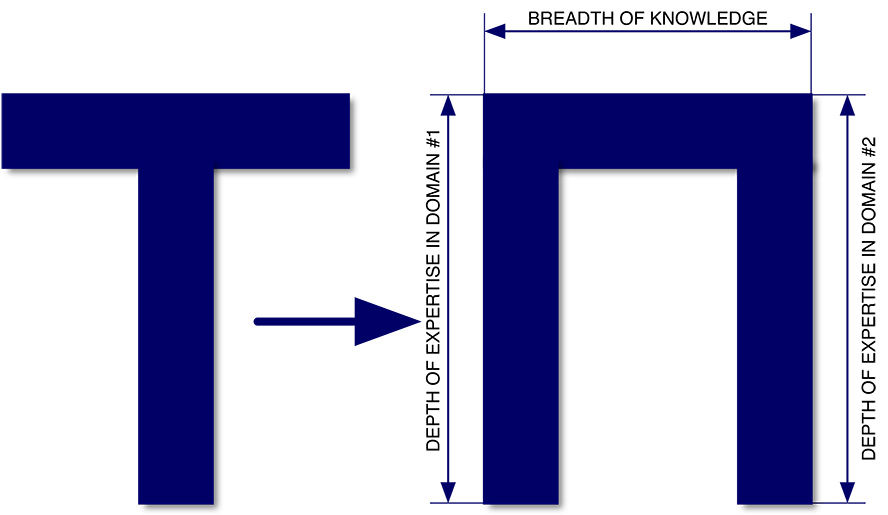

To fully understand their organization’s “neural network” of partners and service providers, the reviewers and IT risk assessors have to have in-depth knowledge of diverse organizational structures, cultures, and processes. In my consulting work, I frequently see these challenges faced by the IT risk professionals. In many cases, a bank’s IT risk assessors evaluating a fintech partner, lack understanding of the differences in organizational culture, structure, and technology architecture choices of a startup. In such cases, empathy certainly helps to bridge the gaps, but only to a degree. To fully understand and accurately evaluate the IT risks of an emerging fintech service provider requires substantial knowledge of the related technologies and first-hand experience with building or managing a fintech startup. The “T” of the T-shaped skill set is getting relentlessly wider, just as the demand for in-depth multidisciplinary knowledge is increasing. As the landscape of the available and emerging technologies and services grows in scope and deepens in texture, the demand for a wider range of skills and competencies among the IT risk professionals will continue to increase. True to the spirit of the original visual metaphor for multi-domain expertise, it might be time to cross the barrier of the Latin alphabet to replace the “T” with the Cyrillic “П” to underscore the need for well-balanced in-depth multi-domain knowledge.

To fully understand their organization’s “neural network” of partners and service providers, the reviewers and IT risk assessors have to have in-depth knowledge of diverse organizational structures, cultures, and processes. In my consulting work, I frequently see these challenges faced by the IT risk professionals. In many cases, a bank’s IT risk assessors evaluating a fintech partner, lack understanding of the differences in organizational culture, structure, and technology architecture choices of a startup. In such cases, empathy certainly helps to bridge the gaps, but only to a degree. To fully understand and accurately evaluate the IT risks of an emerging fintech service provider requires substantial knowledge of the related technologies and first-hand experience with building or managing a fintech startup. The “T” of the T-shaped skill set is getting relentlessly wider, just as the demand for in-depth multidisciplinary knowledge is increasing. As the landscape of the available and emerging technologies and services grows in scope and deepens in texture, the demand for a wider range of skills and competencies among the IT risk professionals will continue to increase. True to the spirit of the original visual metaphor for multi-domain expertise, it might be time to cross the barrier of the Latin alphabet to replace the “T” with the Cyrillic “П” to underscore the need for well-balanced in-depth multi-domain knowledge.